Hdb loan how much can i borrow

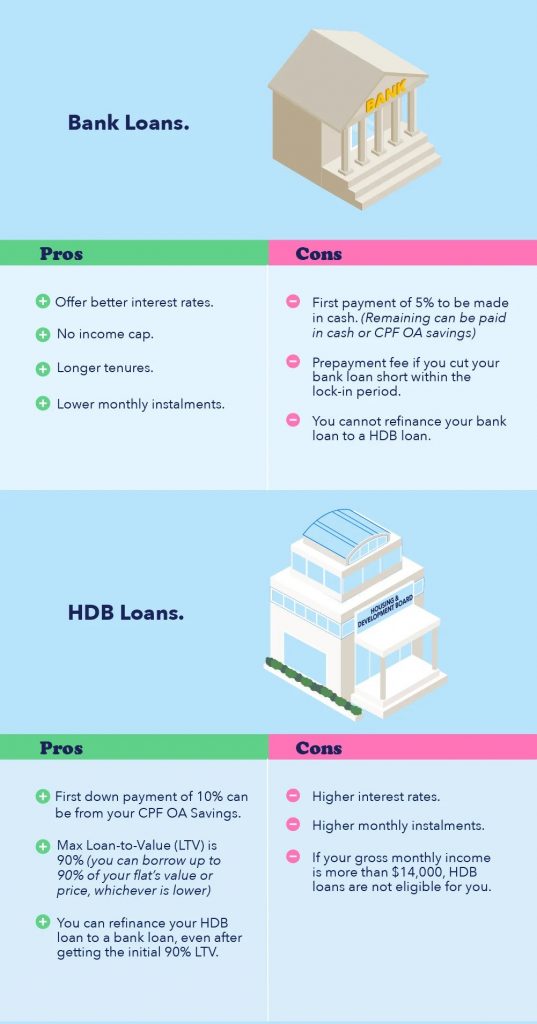

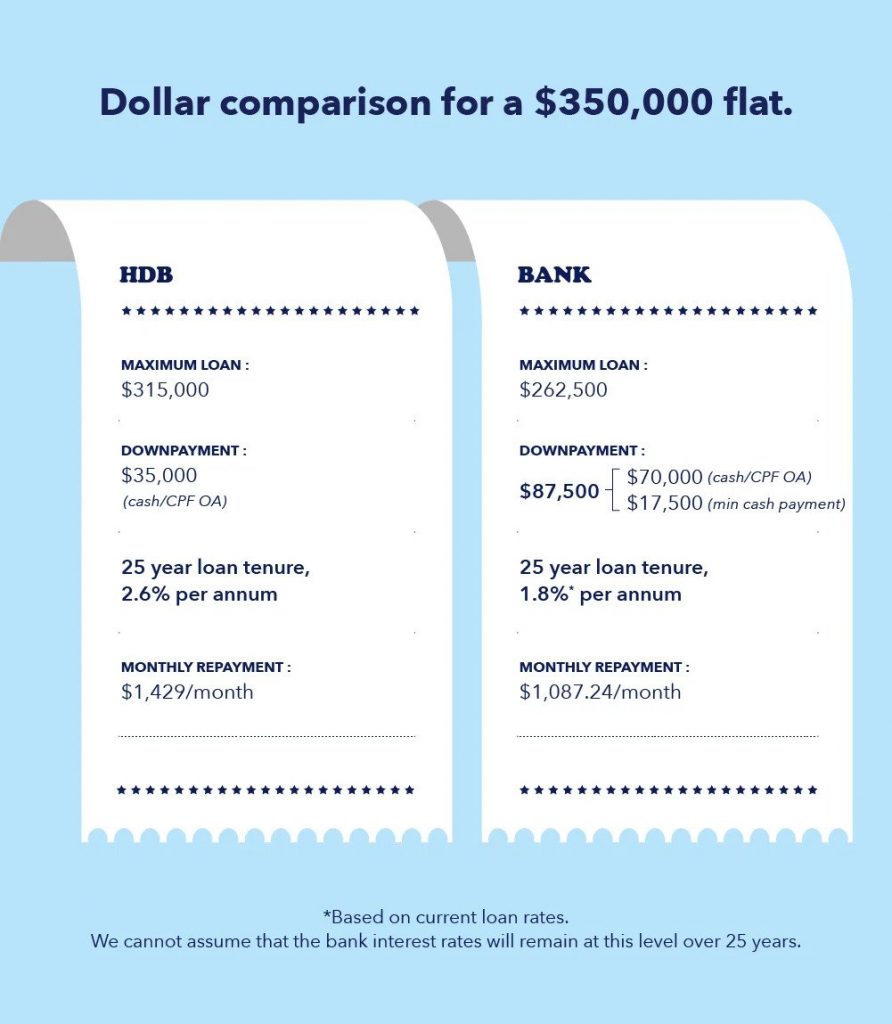

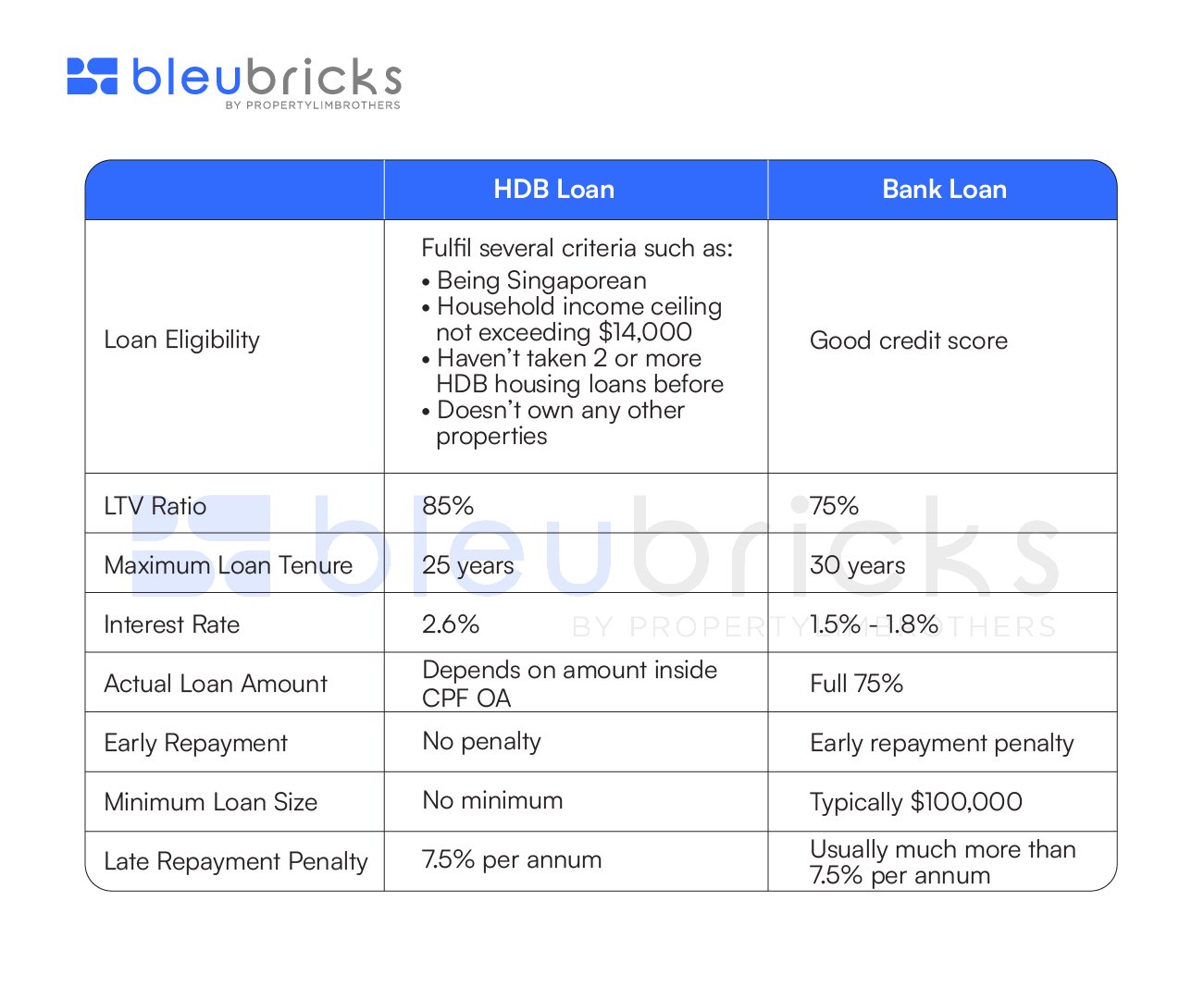

If you want to pay less interest so you can have more savings for retirement a bank loan generally has a lower interest rate than an HDB loan. Cash Over Valuation or also known as COV is an aspect of Singapores HDB market and only used for the resale HDB flat market.

Hdb Credit To Finance A Flat Purchase

Conditions when taking a second HDB housing loan.

. Once you receive the sales proceeds you can repay the bridging loan which in this case is to bridge both the downpayment and a part of the home loan as well. The interest rates of bank loans may fluctuate according to market conditions while the interest rate of an HDB loan is currently pegged at 01 above the prevailing OA interest rate ie. Check out our calculators below to find out how much you can borrow.

85 can be covered through a loan while 15 needs to be paid upfront. 15 of purchase price or market value whichever. The maximum amount in which you are entitled to borrow to finance the home otherwise known as your.

Maximum Loan Amount For OTP dated 16 Dec 2021 and after Up to 75 of purchase price or market value whichever is lower. For bank loans you need to pay at least 5 in cash. Loan On Credit Card.

As reported by Dallas 5000 is the maximum deposit to pay upfront for resale HDB. In addition to meeting the above eligibility conditions your second HDB housing loan amount will be reduced by the full CPF refund and part of the cash proceeds from the disposal of the existing or last-owned HDB flat. Option two is to increase the quantum of the bridging loan to 500000 instead of 200000.

You can take up a loan of up to 450000. If youve taken up a bank loan The LTV is capped at 75 of the. Buy Now Pay Later.

This has been confirmed by Lee as he mentions You can borrow up to 85 of the purchase or valuation price whichever is lower if you take a loan from HDB. This promotes financial prudence and prevents over-borrowing. MSR is capped at 30 of all borrowers gross monthly income.

Now you only need to take a home loan of 450000 45 LTV. Calculation of MSR is based on loan amount and combined monthly gross income. DBS HDB Loan HDB Concessionary Loan.

25 of purchase price or market value whichever is lower. Up to 85 of purchase price or market value whichever is lower. Your maximum home loan amount is determined by TDSR MSR for HDB only loan tenure and a medium-term 35 interest rate.

You can borrow more from HDB 85 compared to a bank 75 HDB loans allow you to pay your downpayment fully using CPF if you have enough savings. Your Loans Against Securities.

Hdb Your Hdb Loan Quantum

Hdb Resale Flat Hdb Loan Versus Bank Loan Propertylimbrothers

Hdb Loan Vs Bank Loan Which Is Better 5 Things To Know Before You Commit Aug 2022

Hdb Mnh Buying An Hdb Flat Here S How To Decide Between Hdb Loans And Bank Loans

Housing Loan Information North Gaia Ec

Hdb Loan Vs Bank Loan Why I Took An Hdb Loan With A Slight Tinge Of Regret New Academy Of Finance

Hdb Mnh Buying An Hdb Flat Here S How To Decide Between Hdb Loans And Bank Loans

Hdb Housing Loan From Hdb

What S The Real Difference Between Buying Private Property In Singapore And Iskandar We Ll Show You Investing Singapore Investment Property

Dpm Tharman Explains The Cpf Scheme

Cpfb 3 Differences Between An Hdb Loan And Bank Loan

5 Costly Mistakes First Time Home Buyers Commonly Make First Time Home Buyers New Home Buyer Best Loans

Hdb Housing Loan From Hdb

1

How Much Can You Borrow For A Hdb Ec Or Condo

Housing Loan Information North Gaia Ec

Hdb Resale Flat Hdb Loan Versus Bank Loan Bleubricks By Propertylimbrothers